Revealing the Possibility: Can Individuals Discharged From Bankruptcy Acquire Credit Scores Cards?

Comprehending the Impact of Bankruptcy

Insolvency can have a profound influence on one's credit rating, making it testing to gain access to credit scores or financings in the future. This economic tarnish can stick around on credit score reports for several years, impacting the individual's ability to protect favorable rate of interest prices or economic opportunities.

Additionally, bankruptcy can limit work opportunities, as some employers perform credit history checks as part of the hiring process. This can pose a barrier to people looking for new job leads or profession improvements. On the whole, the influence of bankruptcy extends past monetary constraints, affecting different elements of a person's life.

Aspects Influencing Bank Card Approval

Following bankruptcy, people typically have a reduced credit scores score due to the negative impact of the bankruptcy declaring. Credit card business commonly look for a credit rating score that demonstrates the candidate's capability to manage credit rating properly. By meticulously taking into consideration these factors and taking steps to reconstruct credit score post-bankruptcy, individuals can improve their potential customers of getting a credit rating card and working in the direction of financial healing.

Actions to Rebuild Credit Scores After Bankruptcy

Restoring credit score after personal bankruptcy calls for a critical technique concentrated on economic technique and regular financial debt monitoring. The primary step is to evaluate your credit record to make certain all financial obligations included in the personal bankruptcy are properly mirrored. It is important to establish a spending plan that focuses on financial obligation settlement and living within your ways. One reliable technique is to acquire a guaranteed bank card, where you deposit a specific quantity as security to establish a credit history restriction. Timely repayments on this card can show liable credit rating use to potential loan providers. In addition, consider coming to be a licensed user on a member of the family's bank card or exploring credit-builder lendings to more improve your credit history rating. It is vital to make all payments on time, as repayment background dramatically influences your credit report. Persistence and willpower are vital as reconstructing credit report requires time, however with dedication to seem economic techniques, it is possible to boost your creditworthiness post-bankruptcy.

Secured Vs. Unsecured Credit History Cards

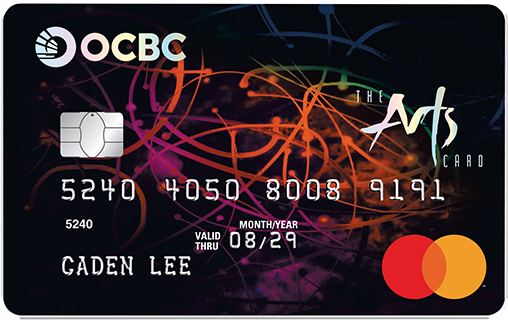

Following personal bankruptcy, people frequently take into consideration the selection between safeguarded and unsafe credit score cards as they aim to restore their creditworthiness and economic security. Safe credit scores cards call for a cash down payment that serves as security, commonly equivalent to the credit scores restriction granted. Eventually, the choice in between safeguarded and unsecured credit scores cards ought to align with the person's financial goals and capacity to take care of credit responsibly.

Resources for Individuals Seeking Credit Restoring

For people intending to enhance their creditworthiness post-bankruptcy, checking out available resources is vital to effectively navigating the credit scores rebuilding process. secured credit card singapore. One valuable source for people looking for debt restoring is credit scores counseling firms. These organizations supply monetary education and learning, budgeting help, and individualized credit rating enhancement strategies. By dealing with a credit history counselor, individuals can get insights into their debt records, learn methods to boost their credit rating ratings, and receive advice on managing their funds successfully.

An additional useful resource is debt surveillance solutions. These services permit people to maintain a close eye on their credit score records, track any mistakes or modifications, and detect potential indications of identity theft. By monitoring their credit report regularly, people can proactively resolve any kind of issues that may emerge and make sure that their debt details is up to day and accurate.

Moreover, online devices and navigate to this site sources such as credit report simulators, budgeting applications, and economic proficiency sites can provide individuals with useful information and tools to help them in their credit scores rebuilding journey. secured credit card singapore. By leveraging these sources efficiently, individuals discharged from insolvency can take purposeful actions towards enhancing their credit scores wellness and protecting a much better financial future

Verdict

To conclude, individuals discharged from personal bankruptcy may have the possibility to get credit report cards by taking steps to rebuild their credit. Factors such as credit scores background, income, and debt-to-income proportion play a substantial role in charge card authorization. By comprehending the influence of bankruptcy, picking in between safeguarded and unprotected bank card, and utilizing resources for credit report restoring, individuals can improve their creditworthiness and potentially get accessibility to bank card.

By working with a credit her latest blog scores therapist, individuals can get insights right into their credit score records, discover approaches to improve their credit scores, and receive advice on managing their funds successfully. - secured credit card singapore